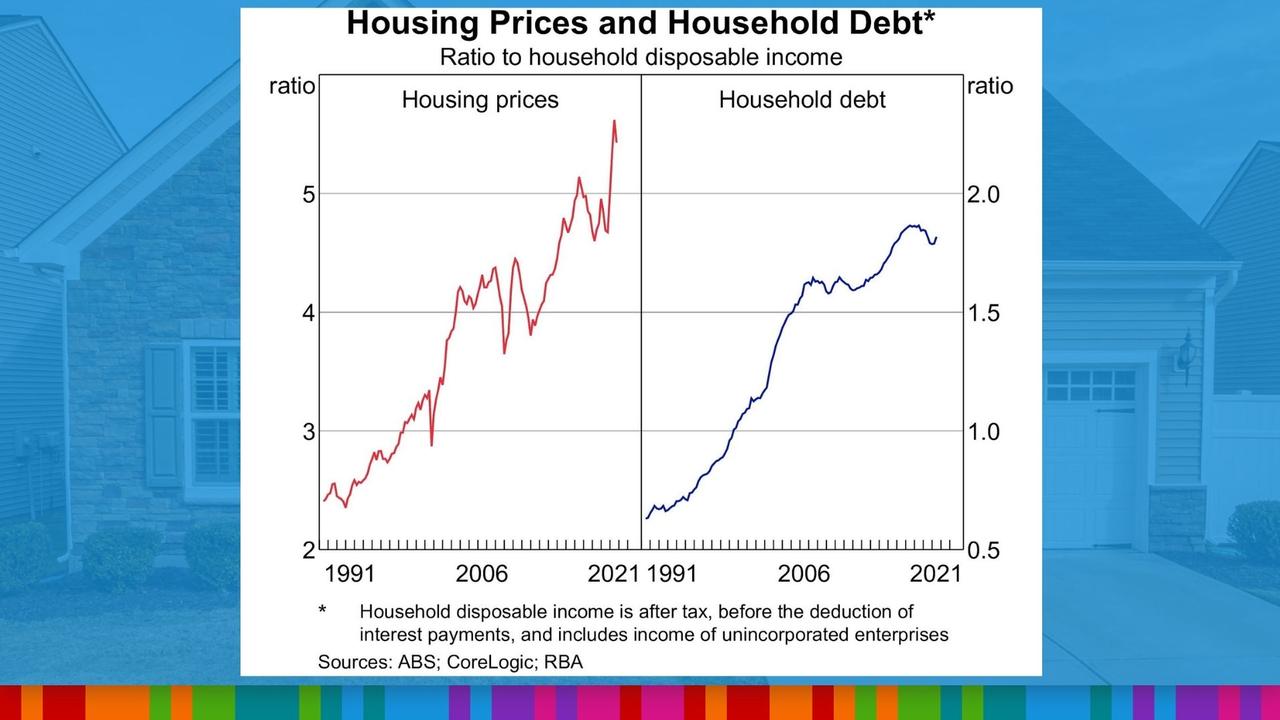

“Households are well-placed to manage further increases”. This rhetoric is being bandied around the traps in a lot of media outlets lately by the RBA, but is this actually the case. Or is it simply the RBA trying to cook the frog by slowly turning up the heat? With debt-to-income ratios close to 1:6, it’s going to be more than first home buyers that feel the pain with rising interest rates.

Interest rates are still below where they need to be: RBA says Ronald Mizen Economics correspondent at AFR.

The Reserve Bank of Australia deputy governor Michele Bullock says the official interest rate is still probably well below where it needs to move, but households are well-placed to manage further increases.

“We’ve got to get it up to some sort of concept of what we call the neutral interest rate,” she said. “We don’t know where that particularly is, but we know it’s a fair bit higher than where we currently are.”

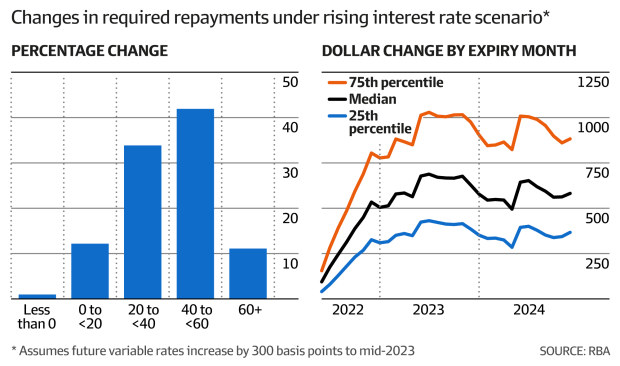

40% rise in repayments

Big four lender Commonwealth Bank tipped two further back-to-back 0.5 percentage point increases in August and September, while ANZ updated its outlook to forecast the cash rate to rise to 3 per cent by the end of this year.

About half of households with fixed-rate home loans would be hit with a 40 per cent increase in monthly repayments if the official interest rate rises to 3 per cent, in line with ANZ and financial market expectations.

Borrowers with fixed-rate loans due to expire in the next 18 months would be hit with a median monthly repayment increase of about 45 per cent, or $650, according to the RBA’s analysis.