There are a few well known property market indicators often cited by experts, analysts and media. The usual predictive metrics are interest rates, availability of credit, employment, inflation, economic growth, consumer sentiment – and we are hearing plenty of talk about all of these at the moment but there is one notable omission that used to be on everyone’s lips a few years ago – and that’s migration. This concept, forgotten since this pandemic, could be a sleeping giant. With borders now open and the world cranking up again, can we look to this forgotten market indicator to have an impact on the Australian property market in the foreseeable future?

“In the years leading up to the pandemic, migration was the largest contributor to Australia’s population growth”.

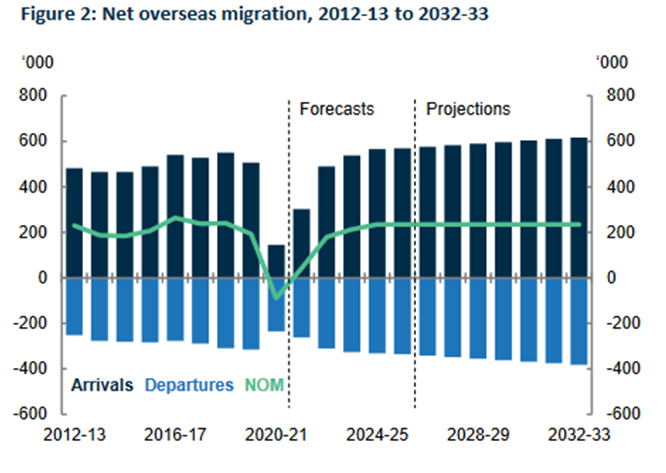

“The introduction of international border restrictions led to the first net outflow of migrants from Australia since just after World War II. NOM decreased from a net inflow of 193,000 people in 2019-20 to a net outflow of 90,000 people in 2020‐21 (Figure 2)”.

“NOM is now forecast to increase to a net inflow of 41,000 people in 2021-22, 180,000 in 2022‐23, and 213,000 in 2023-24. From 2024-25 onwards, NOM is forecast to return to pre-COVID-19 trends and remain steady at 235,000 people for the remaining projections period”.

Figure 2: Net overseas migration, 2012-13 to 2032-33 The outlook for migration is stronger than in the 2021‐22 MYEFO due to higher‐than‐expected arrivals since the international border reopened

Australian Government Centre for Population

“We find that an immigrant inflow of 1% of a postcode’s population raises housing prices by around 0.9% per year. As a result, Australian housing prices would have been around 1.1% lower per annum had there been no immigration”. Monash University – The impact of immigration on housing prices in Australia – Morteza Moallemi, Daniel Melser

Like to know more?

So, if you want to get yourself into the best possible position to manage your mortgage repayments, your family budget and minimize your financial risks, get in touch with us today so we can explore all your finance options.

Our experienced brokers have access to the latest loan facilities being offered by lenders and they can also assist you with making the right decision to suit your personal situation. From new loans to refinancing and fixing the best rates, to private lenders for your property development deals, we have the knowledge and expertise to help you find the right loan.

To find out more about what we can do for you give us a call on 1300 758 379 to discuss the next steps in your loan application!

You can also reach us via our online contact form – leave us a few of your details and someone will be in touch with you soon.